Introduction

Phone insurance is an optional coverage that protects your smartphone against accidents, theft, loss, and mechanical failures beyond the manufacturer’s warranty. With the average smartphone costing around $1,430 in 2024 and millions of devices lost or stolen each year, phone insurance can save you from a huge replacement bill. In this guide, we explain how phone insurance works – including damage, theft, and repair coverage – so you can decide if it’s right for you.

What Is Phone Insurance?

Phone insurance (also called device protection or mobile insurance) is a policy that reimburses you for repair or replacement when your phone is damaged, stolen, or lost. It differs from a standard manufacturer’s warranty in scope. A one-year warranty only covers manufacturer defects, whereas phone insurance typically covers accidents (like drops or spills), as well as theft or loss.

- Coverage Types: Insurance plans may be offered by your carrier (e.g., AT&T, Verizon) or by third parties (e.g., AppleCare+, Asurion, Akko). Some plans also cover other devices (tablets, laptops, etc.) as part of a “device protection” bundle.

- Additional Protection: Homeowners or renters insurance often includes personal property coverage, which can reimburse you if your phone is stolen or damaged by certain perils (like fire or vandalism). However, these policies generally do not cover accidental damage or loss unless you add a specific rider.

In short, phone insurance “fills in where your warranty ends” by protecting against everyday accidents or theft.

Why Do You Need Phone Insurance?

Smartphones are expensive and vital to daily life. Statistics show a high risk of damage and theft:

- Frequent Damage: About 31% of U.S. smartphone owners reported damaging their phone in the past year. The most common accident is a cracked screen, accounting for 67% of incidents.

- High Repair Costs: In 2023, Americans spent $8.3 billion on phone screen repairs. On average, each repair or replacement costs around $302, and total repair/replacement expenses in the U.S. reached $149 billion. These costs can be unexpectedly high when you need your phone working.

- Theft/Loss Risk: Every year, roughly 19 million phones are lost or stolen in the U.S.. Globally, smartphone theft losses exceed $3 billion annually, and the average replacement cost for a stolen phone in the U.S. is over $800. Notably, 1 in 3 U.S. phone users will have their device stolen or lost at some point.

Given these risks, phone insurance can be a wise investment. If your phone is broken or gone tomorrow, insurance can spare you from paying the full replacement price out-of-pocket. As one insurance advisor notes, most plans “come in handy if your device breaks, gets lost, or is stolen,” helping you avoid a $1,000+ replacement bill.

What Does Phone Insurance Cover?

Phone insurance typically covers three main areas: accidental damage, theft/loss, and repair/replacement service. Coverage details vary by plan, so always read the fine print.

Accidental Damage Coverage

Smartphone with a cracked screen illustrating typical accidental damage.

Most phone insurance plans cover accidental damage. This includes mishaps like dropping the phone (cracked or shattered screen), liquid spills or submersion, and other unintentional damage. Carriers and providers often highlight screen repairs: for example, AT&T’s Protect Advantage plan explicitly covers cracked screens with unlimited repairs. According to a survey by Allstate, damaged screens are by far the most frequent phone accident (67% of cases).

Common examples of accidental damage covered:

- Cracked or smashed screen: Repair or replacement of a shattered display.

- Liquid damage: Spills, rain, or dropping the phone in water.

- Drop impacts: Cracks to the back glass, bent frames, or broken buttons from falls.

- Hardware issues after mishaps: e.g., loose headphone jack, faulty charging port.

- Wear-and-tear parts: Some policies also cover normal battery wear or mechanical failures after the warranty ends.

Plans usually have a deductible (often $50–$200) that you pay when you file a claim. But covered repairs beyond that cost are paid by the insurer.

Theft and Loss Coverage

Lost smartphone in fallen leaves, representing a stolen or lost device.

A key feature of many phone insurance plans is theft protection. If your phone is stolen or forcibly taken (e.g., mugging, pickpocket), insurance will reimburse you for a replacement device (minus your deductible). Some plans also cover “loss” (misplacing your phone) — though often only if you opted into loss protection — while others require evidence of theft. Always confirm whether “lost phone” is included or if only theft is covered.

To illustrate the stakes: replacing a high-end stolen phone can cost $800+. Note that homeowner/renters insurance can cover stolen phones under personal property clauses, but usually with a large deductible. One survey finds that 5% of smartphone owners had their phone stolen in the past year. With insurance, however, you’d only pay the deductible rather than the full retail price of a new device.

Repair and Replacement Service

After an incident, phone insurance typically handles the repair or replacement process for you. Many plans offer same-day or expedited service. For example, AT&T Protect Advantage advertises same-day replacement and setup via authorized stores and UbreakiFix locations. Similarly, other carriers and providers (Asurion, AKKO, etc.) offer fast claims processing through online portals.

Covered services usually include:

- Screen and back-glass repair: Unlimited replacements at many providers.

- Authorized repairs: In-network repair shops (e.g., uBreakiFix) or mail-in repair with guaranteed parts.

- Replacement phones: If the device can’t be fixed (or is stolen/lost), you get a replacement of equal value (often refurbished). Insuredbetter.com advises checking before buying whether a plan provides a brand-new phone or a refurbished model.

- Accessory replacement: Some plans even cover original accessories (charger, earbuds) if damaged.

Overall, phone insurance aims to minimize downtime. Whether it’s fixing that shattered screen or replacing a stolen phone, carriers compete on how quickly and conveniently you can get a working device again.

What’s Not Covered by Phone Insurance?

Not everything is covered under typical phone insurance. Common exclusions include: intentional damage (if you break your phone on purpose), loss of accessories (unless specified), and misuse or unauthorized repairs. Warranties and insurance both usually exclude damage from natural disasters or war. Crucially, manufacturer warranties do not cover accidental damage or theft, and similarly, some phone insurance plans may exclude simple loss (only covering theft). For example, Lemonade notes that standard homeowners/renters policies won’t cover phone damage from accidents or mere misplacement. Always review the policy’s fine print: things like “loss” vs. “theft,” lost data, or cosmetic scratches are often not insured.

Cost of Phone Insurance

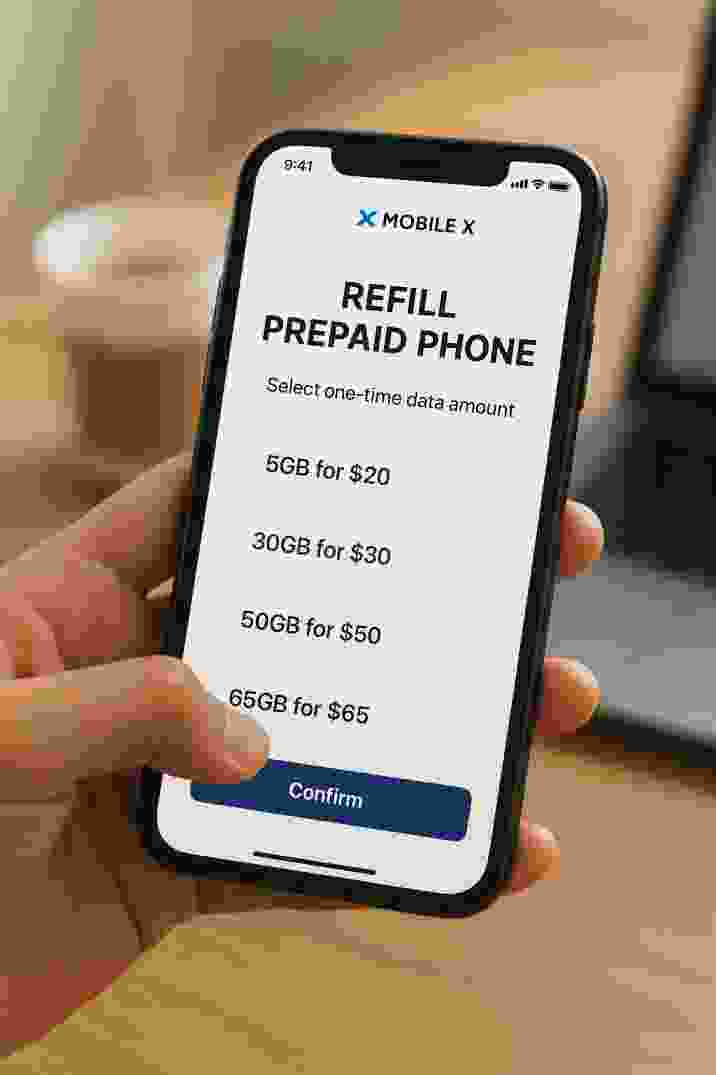

The cost of phone insurance varies widely by provider, coverage level, and device value. Here are some typical figures:

- Monthly premium: Individual coverage often runs between about $6 and $15 per month per phone. For example, Asurion notes average premiums around $12–15 for single-device plans. Lemonade estimates carrier plans start around $9/mo and retailer (e.g. AppleCare+) plans around $11/mo. Some companies offer family plans or multi-device discounts (e.g. an extra $2–3 per additional phone).

- Deductible/service fee: When you make a claim, you usually pay a deductible. Many policies have deductibles in the $50–$200 range. (For example, Progressive offers a 2-year plan with a $75 deductible.) Higher-end phones typically have higher deductibles.

- One-time plans: A few insurers sell 12- or 24-month policies for one upfront price. Insuredbetter.com cites Progressive’s 2-year premium of $153 (about $6.40/mo) with a $75 deductible, which covers theft, loss, and accidents.

To decide if insurance is worth the cost, multiply your monthly premium by the coverage period and add expected deductibles. If that total exceeds the cost of simply buying a new phone outright, insurance may not save money. However, many people value peace of mind over breaking even on paper – especially since most cannot easily afford a sudden $1,000 replacement (37% of Americans lack $400 in savings).

Phone Insurance vs. Warranties and Other Options

Phone insurance complements but does not replace other protections:

- Manufacturer’s Warranty: As noted, a typical warranty (Apple, Samsung, etc.) lasts 1 year and only covers defects. It will repair or replace a malfunctioning phone if you haven’t dropped it or spilled on it. It does not cover accidents or theft.

- Credit Card Coverage: Some credit cards offer cell phone protection if you pay your phone bill with the card. This coverage often reimburses a limited amount (e.g. up to $600/year) for theft or damage, with conditions (usually two claims per year). It’s worth checking your card benefits, but note limits and claims processes.

- Homeowner/Renter’s Insurance: These policies may reimburse you for a stolen phone or damage from named perils (like fire), but usually with a high deductible (often $500+). If you claim a stolen phone on a home policy, you’ll pay the deductible and then taxes on the replacement cost (paying only the cash value). Some policies require you to “schedule” an expensive device separately. Lemonade points out that renters insurance does cover theft and vandalism of phones, but not accidental drops.

- Upgrade/Protection Plans: Mobile carriers often offer their own upgrade programs (trade-in phones every year) or pricey protection plans. These may guarantee upgrades rather than repairs. Consider the out-of-pocket cost and restrictions.

In summary, if you’re mostly concerned about defects, the warranty may suffice. If you want broad protection against accidents, theft, or loss, dedicated phone insurance is the way to go.

How to Claim Phone Insurance

Filing a claim is usually straightforward: contact your insurer via their app or website, or call their claims line. You’ll need details like your phone’s IMEI or serial number and a description of what happened. Then:

- Pay Deductible: You’ll pay the deductible or service fee agreed in your plan.

- Get Repair/Replacement: The insurer directs you to an authorized repair center or mails you a replacement phone. Many plans offer free shipping or in-person service. For example, carriers like AT&T partner with uBreakiFix (by Asurion) for same-day repairs.

- Phone Swap: If your device is unusable or stolen, the insurer will ship you a replacement (usually refurbished) of comparable value.

- Activation: Often, agents will help transfer data or set up the new phone.

Make sure to file promptly: for stolen phones, you may need to file a police report or disable the device. Keep records (receipts, serial number) in case of audit.

Tips for Buying Phone Insurance

To choose the best phone insurance:

- Assess Your Risk: If you tend to drop phones, travel frequently, or live in a high-theft area, insurance is more valuable. Asurion suggests asking: Do you rely on your phone daily? Do you have kids with phones? Can you afford a large replacement cost quickly? If you answered yes, coverage may be worth it.

- Compare Coverage: Look at multiple plans. Key questions: Does it cover loss as well as theft? Is water damage included? How many claims per year? Will I get a new phone or refurbished? Insuredbetter recommends checking exactly what’s covered and whether the replacement is new or used.

- Check Costs: Compare monthly premiums and deductibles. Remember a cheaper premium may mean a higher deductible or more exclusions. Calculate total cost over the time you’ll keep the phone.

- Read the Fine Print: Watch for exclusions like “loss of data,” cosmetic damage, or failures covered by the manufacturer. Check waiting periods (some insurers require you to buy within 30 days of purchase).

- Shop Around: Besides carrier plans, consider third-party insurers (SquareTrade, Akko, Worth Ave) and even bundled plans (homeowners add-ons). Sometimes credit card perks or trade-in programs can save money if you upgrade often.

Choosing phone insurance is a personal decision. If paying for repairs or replacing a device would be a hardship, insurance can be a lifesaver. Otherwise, you might opt to self-insure (save the premium in a savings account) or use warranties.

Conclusion

Phone insurance offers peace of mind by covering expensive repairs and replacements for a device you use every day. It explained covers everything from cracked screens and water damage to stolen or lost phones. While paying monthly premiums and deductibles is not free, it can be far cheaper than footing the full replacement cost for a smartphone. Given the rising cost of phones and the frequency of accidents, many find that phone insurance is worth it.

In the end, weigh the cost of coverage against the value of your phone and your personal risk. Phone insurance isn’t mandatory, but it can save you hundreds (or even thousands) in the long run. Have thoughts or questions about phone insurance? Share your experience in the comments below, and feel free to share this guide on social media to help others make an informed decision!

Frequently Asked Questions

- What does phone insurance cover?

Most phone insurance plans cover accidental damage (cracked screens, water damage, drops), theft, and in some cases loss (if explicitly included). They also typically cover repairs for mechanical failures after the warranty. Check your specific policy for details – some plans even cover accessories or normal wear issues. - Is phone insurance worth it?

It depends on your phone’s value and your ability to pay for repairs. If your phone is a high-end model, relies heavily on it daily, or you frequently encounter accidents, insurance can save money. For example, replacing a shattered flagship phone can be $300-$400, whereas a one-year insurance plan might be less. However, if your phone is old or inexpensive, and you’re careful with it, self-insuring (paying out-of-pocket) may be cheaper. - What is the difference between phone insurance and a manufacturer warranty?

A manufacturer warranty (like Apple’s or Samsung’s) only covers defects and usually only for 1 year. It will fix malfunctioning parts that fail under normal use. Phone insurance, by contrast, covers accidents and often theft or loss, but usually not simple manufacturing defects. Many people have both: the warranty handles breakdowns and the insurance handles drops and theft. - Does phone insurance cover lost phones?

It depends on the plan. “Theft” coverage generally means someone took your phone. Some plans will only pay if you can prove theft (e.g. police report). Others offer an extra option for “loss” if you simply cannot find the phone. Homeowners/renters insurance often only covers theft (not loss). Always read the policy wording: if “loss” is not included, an insurer may deny a lost-phone claim. - How much does phone insurance cost?

Typical cell phone insurance runs roughly $6–$15 per month for a single phone. Premiums vary by phone model and provider. Deductibles are often around $50–$150, depending on the plan. For example, one carrier insurance might be $9/mo with a $100 deductible, while another might be $15/mo with a $50 deductible. Shop around for the best combination for your device. - How do I file a phone insurance claim?

You usually file a claim online or via the insurer’s mobile app. You’ll provide details of the incident (and possibly a police report for theft). Then you pay your deductible and follow instructions: either ship the phone to a repair center or take it to an authorized shop. The insurer will then repair or replace your phone and ship it back to you. - What isn’t covered by phone insurance?

Common exclusions include intentional damage, unauthorized modifications or repairs, and loss of data. Many plans exclude “cosmetic” issues that don’t affect function. Also, damage from natural disasters or war is usually excluded. Manufacturer defects under warranty are not covered by insurance, and some policies exclude pure “loss” (only theft). Always double-check your specific terms to know what’s excluded.

Sources: Insights from industry research and providers (Lemonade, Asurion, Allstate, insurer guides) and 2023-2025 data.